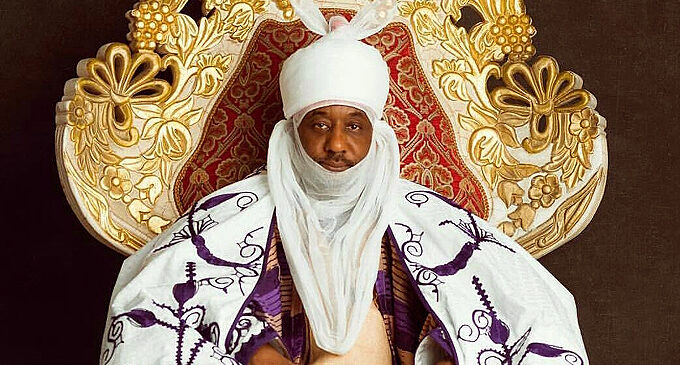

Emir of Kano

| Title: | Emir of Kano aka Sarakin Kano |

| Full Name: | Sanusi Lamido Sanusi |

| Lineage: | |

| Coronation: | 08-06-2014 |

| Palace: | na |

| State: | Kano |

| Profile: | Education Sanusi received his primary education at St. Anne’s Catholic Primary School in Kakuri, Kaduna from 1967 to 1972, where he obtained his First School Leaving Certificate. He then attended King’s College, Lagos, where he graduated in 1977. Sanusi was offered provisional admission to Ahmadu Bello University (ABU) in Zaria, where he obtained a bachelor’s degree in economics in 1981. He received a master’s degree in economics from the school in 1983, and taught there until 1985. Sanusi studied at the International University of Africa in Khartoum, receiving a degree in Islamic law. He was posted to Gongola State (now Adamawa and Taraba States) for his mandatory National Youth Service Corps (NYSC) service.Career In 1985, Sanusi was hired by Icon Limited (a subsidiary of Morgan Guaranty Trust) and Barings Bank. He joined the United Bank for Africa in 1997, working in the bank’s credit and risk-management division, and rose to the position of general manager. In September 2005, Sanusi became a board member of the First Bank of Nigeria as an executive director in charge of risk and management control. He was appointed Group Managing Director (CEO) in January 2009. At this time, Sanusi was chairman of Kakawa Discount House (where he was a board member of FBN Bank). He was the first person from northern Nigeria to be appointed CEO of FBN. On 1 June 2009, during the presidency of Umaru Musa Yar’Adua, Sanusi was nominated governor of the Central Bank of Nigeria; his appointment was confirmed by the Nigerian Senate on 3 June 2009, during a global financial crisis. He is recognized in the banking industry for his contribution to a risk-management culture in Nigerian banking.[8] First Bank is Nigeria’s oldest bank, and one of Africa’s largest financial institutions. Sanusi was the first northern Nigerian CEO in First Bank history. Central Bank governor In August 2009, Sanusi led the central bank in rescuing Afribank, Intercontinental Bank, Union Bank, Oceanic Bank and Finbank with ₦400 billion of public money and dismissing their chief executives. In September 2009, he said that 15 of the present 24 Nigerian banks might survive reform. In a December 2009 Financial Times interview, Sanusi said that he had initiated extensive reforms since taking office (known as the “Sanusi tsunami”). Some believed that he had a vendetta against some CEOs, and others pointed to proof of mismanagement of funds by some CEOs (most notably Cecelia Ibru) as justification for the steps he implemented. According to Sanusi, there was no choice but to attack the powerful and interrelated vested interests who were exploiting the financial system. He expressed appreciation of support from the president, the Economic and Financial Crimes Commission, the finance minister and others. In January 2010, Sanusi said that the banks would only want to give credit to Nigeria’s small and medium enterprises (SMEs) if the government paid adequate attention to infrastructure. He admitted that since 2005, the central bank had not conducted routine examinations of the 14 banks allocated to it under an arrangement with the Nigerian Deposit Insurance Corporation (NDIC). Abubakar Nagona, president of Integrated Development and Investment Service (IDIS, a venture capital investment company), urged Sanusi to “not be cowed and succumb to undue pressure from operators of the same sector he is striving to bring sanity to.” At a February 2010 conference on Nigerian banking, Sanusi described his blueprint for reforming the Nigerian financial system. The blueprint was built around four pillars: enhancing the quality of banks, establishing financial stability, enabling healthy financial sector evolution and ensuring that the financial sector contributes to the real economy. Later that month, Sanusi said that the crash in the capital market was due to financial illiteracy on the part of Nigerian investors. The Banker recognized him as the 2010 Central Bank Governor of the Year, citing his radical anti-corruption campaign aimed at saving 24 banks on the brink of collapse and pressing for the managers involved in the most blatant cases of corruption to be charged and (in the case of two senior bankers) imprisoned. Sanusi has spoken at a number of distinguished events, including the February 2012 Warwick Economics Summit (where he spoke about banking reforms in Nigeria and their impact on the economy). Emir of Kano After Sanusi urged his followers to fight the Nigerian Islamist group Boko Haram, the Kano Mosque (the seat of his emirate) was bombed in November 2014; 150 people were killed. In December 2014, Boko Haram leader Abubakar Shekau accused him of deviating from Islam and threatened his life. Sanusi replied that he is “safe with Allah”, and likened Shekau’s comments (describing Sufis as unbelievers) to those of the heretical Islamic preacher Maitatsine. |